A Justice-Based Framework For Web3 Venture Investments

The venture-backed pathway to prosperity has revolutionized industries, generated massive wealth, and created countless opportunities for global talent to thrive. But despite their seemingly unrivaled role in fueling positive world changes, venture investments have yet to capitalize fully on a tremendous opportunity to create meaningful social and economic justice. Widening wealth gaps, worsening climate disruption, lack of diversity in leadership, and unethical mega-corporation practices underscore the timeliness of the moment. For a venture industry that has focused so successfully on facilitating innovations of historic proportions, the emergence of ESG and socially responsible investing marks only the beginning of what’s possible.

Today, the Web3 revolution has further heightened the stakes of justice. Proponents of a blockchain-connected world, echoing the optimism of the dot.com-batty evangelists of twenty-five years ago, have claimed that Web3’s transparency and decentralization may indeed lead to a future of reclaiming individual rights and egalitarianism. We share their excitement, and we’re eager to see how decentralized projects might lead to new solutions for seemingly intractable problems and injustices. At the same time, we know that Web3 – like innovations before it– is susceptible to many of the same risks that played out with Web1 and Web2, as well as some novel ones. Indeed, the recent collapse of some of the crypto industry’s biggest and most trusted players has only deepened Web3 skepticism, not to mention scrutiny from regulators.

In the long run, we believe that the best Web3 ventures will defy the skeptics and prove the technology’s full potential. But an individual project’s success is far from guaranteed

In the long run, we believe that the best Web3 ventures will defy the skeptics and prove the technology’s full potential. But an individual project’s success is far from guaranteed. Without an intentional justice-first approach to innovation by both investors and innovators alike, we fear that a naive optimism around Web3’s structural egalitarianism will unintentionally culminate in a wave of insurmountable injustices that could eclipse the significant problems we already face today.

In light of these heightened stakes, we propose that the venture industry and founder community can each derive benefit from a new and collaborative justice-driven framework that can facilitate the change to which many investors and founders are already personally committed. This framework can become a shared headspace for the two groups– investors and founders– to come together to create lasting economic and social value.

We thus propose three core elements that should serve as north stars for a new collaboration between justice-driven innovators and investors looking to create both justice and profit in the Web3 world. As we explain, these elements leverage the convergence of business and justice in traditional areas that touch product-market fit, market-sizing, team-building, and strategic partnerships.

We thus propose three core elements that should serve as north stars for a new collaboration between justice-driven innovators and investors looking to create both justice and profit in the Web3 world

The core elements for justice-based collaborations are: (1) select an endeavor that seeks to remedy a massive unjust or unethical shifting of value, while maintaining a venture-justified business model, (2) leverage the blockchain to recruit a highly motivated and distributed group of part-time experts, including DAO contributors, and (3) situate each ambitious effort within a trustworthy enforcement or accountability system that provides powerful justice-based leverage.

1. Remedy A Massive Injustice or Unethical Shifting of Value

Even if Web3 is able to maintain its independence from entities that seek to consolidate ownership and strip the blockchain future of its egalitarian hopes, corporate harms perpetuated over the past decades will be insufficiently remedied. It is indeed naive to think that decades-old harms of corporate fraud, environmental contamination, labor exploitation, and consumer deception will willingly slow down on their own and disappear in the face of more equitable Web3 forces. At best, even with a remarkably strong Web3 that becomes incorruptible, we estimate that trillions of dollars captured over the past decades through unethical or illegal means are being deployed in search of further profits and with little fear of consequences. And while we are steadfastly supportive of innovation leading to significant profit, one must draw a clear moral line when the future is uncertain and fragile.

Thus, real justice in the Web3 era provides an opportunity to strategically (and profitably) confront past wrongs with creative business models aimed at realigning resources equitably in a new kind of effort that leverages all that blockchain has to offer. Remedying environmental harms and consumer fraud stand as clear examples of areas in need of strategic intervention. In both cases, firms causing harm have– and continue to– employ economic analyses that balance expected profits against the (low) risk of being caught, qualified by the often small magnitude of economic loss that detection brings. Unfortunately, public, private, and nonprofit sector efforts at halting such unethical choices have failed, raising the question of whether Web3 can provide the tools to respond to such a systemic illness (and, as we discuss, whether such efforts can bring meaningful return on investment).

In our proposed world of venture-backed Web3 justice, then, it is crucial to identify a particular type of injustice that not only is large enough to create a material return on investment when addressed properly, but also one that does so without eviscerating meaningful economic justice to any and all victims. Thus, not all justice-driven Web3 forays become a worthwhile venture-supported fight.

We propose that new firms must find the perfect balance when selecting a powerful injustice to remedy, and do so in a way that meets the needed financial elements of three parties: the venture investor, a justice-focused audience, and the victims themselves. To ensure that each such endeavor surpasses the required minimum standards, we propose confirming:

- Does the justice-backed monetization model indicate a fundamentally sustainable enterprise? For example, is there enough cash flow to allow the entity to continue pursuing social justice post-investment?

- Second, will the new venture deliver a reasonable return to investors and justify the investment? If not, the venture will be unable to meet its mandate and the venture should consider alternate funding sources.

- And third, and perhaps most importantly, will the justice-focused business model result in a meaningful shift in resources and provide victim-centered redress for those harmed?

At their core, these questions essentialize a type of market-sizing analysis conducted at most venture-backed companies. But we suggest that the market sizing of justice should not only follow both the traditional bottom-up and top-down best practices, but also that it must incorporate an additional element: how much justice will it actually create for previously harmed citizens, and how do we quantify the economic and social impact?

Once a new enterprise has selected a business focus that will result in a massive, ethical shifting of resources, constructed a business model that will satisfy the elements of our test, and verified both financial and real-world impact through the use of modified market-sizing, it becomes time to move to the next north star, the one focused on the team.

2. Leveraging the Idle Capacity of Motivated, Part-Time, Distributed Experts

The typical approach to leadership in the entrepreneurship literature would perhaps never embrace a quick turn to non-founding, non-employee, part-time outsiders to make the most tangible impacts on a start-up. And of course, we concur with the notion that a founding team’s entrepreneurial passion is a meaningful predictor of success. But in the Web3 justice context, we are necessarily talking about leveraging a different kind of leadership model than the kind that can be generated by focusing on a core team alone; we are talking about talented global contributors with existing careers and expertise who become the passionate, dedicated, and impactful justice army.

As each of us make our way through our professional lives, only a limited number of justice-aligned professionals make the choice to pursue justice as a full-time career. Those who do tend to gravitate to the nonprofit sector or the foundation world. Stories of intrinsically motivated professionals turning into corporate worker bees, never to turn back, are easy to find. The private sector is indeed packed with righteous talent who often simply cannot afford to pursue their justice interests.

The exhausted corporate attorney, the lonely auditor, the organizationally constrained big-pharma scientist, or the job-insecure journalist all stand the chance to be invigorated by a justice-driven web3 world. But how?

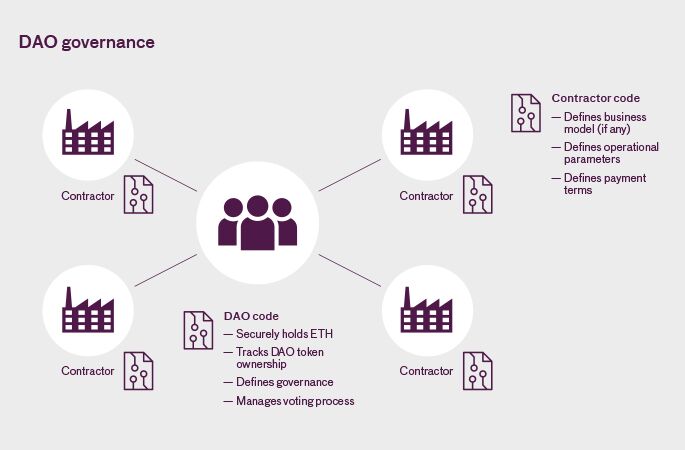

This is where Decentralized Autonomous Organizations (DAOs) come in. Designed to leverage “on-chain” relationships, meaningful contributor participation and governance, as well as token-based compensation, these frameworks have the potential to be a game-changer not just for reorganizing a range of traditional organizations, but particularly for justice-based efforts. Building on section 1, in which we identified the importance of remedying a significant injustice while compensating victims, this section proposes that DAOs will provide the key human resource tool with which to leverage the talents and excitement of previously hibernating justice-driven contributors.

These frameworks have the potential to be a game-changer not just for reorganizing a range of traditional organizations, but particularly for justice-based efforts

These contributors can and will likely fit multiple prongs of the following profile: They will (1) care deeply about the justice-based issue being addressed by the company, (2) have an expertise that gives them a particular skill set that can be leveraged, (3) have gainful employment that they are not necessarily looking to leave for the startup or non-profit world, and (4) seek fulfillment and community that are not being fully satisfied by their current career. Alerted to the potential of part-time, fairly compensated, cutting-edge justice work on an issue they care about, these people will readily join the effort.

Built strategically, these outside, part-time, expertized teams will provide potentially unlimited scalability for the best organized justice-driven agendas. Imagine chemists, surveyors, radiologists, accountants, lawyers, and more, lending their talents. Combined with the existing experts in building Web3, DAO members will serve to connect Web3 companies with justice that can and must occur off the blockchain.

Built strategically, these outside, part-time, expertized teams will provide potentially unlimited scalability for the best organized justice-driven agendas

Consider, for example, a new venture that seeks to reverse the course of toxic forever chemicals through strategic efforts. The new entity can leverage a partially decentralized DAO structure to enlist relevant subject matter experts including: chemical engineers, surveyors, satellite experts, chemists, water and soil sample gatherers, forensic scientists, nurses and medical technicians, and on and on. Although there will be a visionary and centralized leadership team at the company level driving the overall effort, thus situating the DAO in the category of a partially or progressively decentralized DAO, the DAO team will be a partially autonomous group responding to every need, fulfilling key tasks, voting and governing as needed, and adjusting on the fly to accomplish tasks.

Imagine that the effort is one to hold chemical creators and manufacturers financially responsible for the harms they created over a period of decades. In this context, separate DAO teams could: (1) work to understand the scientific scope and scale of a historical or present-day chemical manufacture or distribution, (2) perform a sort of public forensic-style audit of a company’s financial or other disclosures, (3) assess the impact of human harms never before studied, and (4) prove a causal connection between a compound and a human, animal, or environmental impact. Few of these things would be possible, with such swiftness and scale, in a traditional organization, and perhaps none would be possible in a traditional startup environment.

With the idea validated and tested, and a scalable and partially-decentralized team ready to go, it may seem that this justice-focused company is ready to launch. Yet, there is a huge David versus Goliath problem: without some structural help, David probably cannot win a battle over unethically allocated resources.

3. Leverage Through a Reliable Accountability System

Taking on multi-billion dollar enterprises that have chosen repeatedly to transgress, even when a venture is armed with an impactful value shifting model, a morally driven team of founders, and expert DAO contributors, is still unlikely to be enough to flip the script on decades of ethically questionable yet highly profitable tactics. Unethical corporate entities will continue to be under-deterred. Thus, in order for even the most visionary justice-driven Web3 entities to have a meaningful chance at providing a generational shift in impact, these ventures must strategically tap into existing legal, administrative, international, or societal structures that provide the moral authority and rules-based organizational leverage needed. This leverage will serve as a heavy anchor and provide the chance for a justice-focused startup to make it over the top without being toppled by resource-flush resisters.

Depending on the domain in which the justice-based work is centered, being able to rely on a shared set of rules, expectations, or laws can serve an adjudicatory function, a way to enforce resolution of an inequality, with teeth. It can also provide access to a leadership or governing structure to ensure that a just redistribution of wealth occurs once an injustice is revealed and detailed. For example, the legal system can serve as an anchor for all justice efforts that wish to tap into the civil litigation system to hold entities accountable for harmful practices. Our forever chemical example above is relevant here, in that one important result of that work would be high-impact strategic litigation. A battle between a startup and a massive defendant certainly doesn’t guarantee a win within the legal system, but nonetheless law’s rules and fairness-driven norms can anchor such strategic efforts while providing the potential of meaningful recovery for true victims.

Outside of the legal system, other accountability systems can provide meaningful anchors for new ventures. Treaties, the United Nations, international laws, arbitrative bodies (domestic and global), village or local councils, private entities like the World Bank with their own enforcement powers, nationally adopted auditing and accounting rules and procedures, and even ESG rules and organized consumer-driven pushback are all possible venues that can serve to amplify the impact of David v. Goliath battles.

Outside of the legal system, other accountability systems can provide meaningful anchors for new ventures

Conclusion

With these tools at hand, ventures need not rest their hopes of transformational change on Web3’s decentralization and on-chain transparency alone. Rather, leveraging an impactful resource-shifting mission with a business model, a strong decentralized team of experts, along with adjudicatory leverage, Web3 ventures can begin to unwind decades of injustice, all while providing meaningful return to investors. Without these elements, Web3 may simply end up providing just a new set of rerouted pathways that reward centralized power-brokers at the expense of talent.

Recent economic lessons, including the swift realignment of early-stage venture money, underscore the importance of following this model. Venture funds pumped the brakes on investment pipelines, switching their focus from dealmaking to slowing portfolio companies’ cash burn. DAO innovators began complaining about untenable structures and disengaged contributors, all while the expected economic independence of crypto began to falter as Bitcoin, Ethereum, and others seemed to fall, rise, and fall again with equity markets. Echoing our concerns, the talk of Web3 as a global justice conduit began to fade away, replaced by conversations that mimicked more traditional economic and investment discourse.

Though instability remains as we look toward the future of venture creation, as the dust of the latest realigning of the crypto industry begins to settle, a new horizon is emerging, one in which the promises of wealth, power-sharing, and even justice remain, but are situated within a risky environment that requires greater intentionality and precision to actualize on all three elements of the crypto triple threat. This Article has amplified the importance of, and opportunities around, maintaining a meaningful and lasting justice focus in the Web3 world, and proposed that investors and founders can follow a thoughtful, focused approach that can begin to make a true justice-based impact, globally.